A new and interesting toolset is now in use in Germany in restructuring practice to avert insolvency. This preventive restructuring framework is a legally regulated set of instruments which for the first time enables restructuring counter to the will of individual creditors, even outside of insolvency proceedings.

The following five questions first have to be answered in the affirmative for this new option to be viably usable.

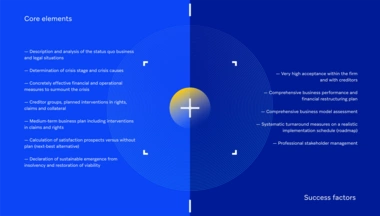

- Has a comprehensive, turnaround-focused corporate or restructuring concept been presented?

- Is the company overburdened with debt, thus requiring restructuring of its balance sheet liabilities in particular?

- Is the company facing imminent insolvency within the next 24 months?

- Have there been any obstruction attempts thus far, such as blocking a potential restructuring plan, or are such attempts expectable?

- Can the instruments per the StaRUG Restructuring Act be used to bring about a solution that takes into account the relevant interests and contributions of the stakeholders?

If these questions are answered in the affirmative, very interesting solutions are possible with StaRUG which were previously unavailable, including particularly the possibility of overruling creditor minorities (“accord disruptors” especially) and obstructive creditor groups.

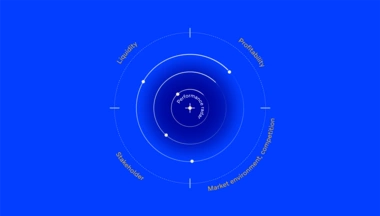

To obtain the support of a majority of creditors nonetheless required, a comprehensive, transparent and resilient turnaround plan is still required, as a majority of creditors have to be convinced that restructuring makes sense and has prospects for success. Successful execution of the restructuring project, with or without the StaRUG options, is made possible by seeking unbiased, holistic advice at an early stage.